Last episode we took a look at how to invest in REITs, real estate mutual funds and ETFs as part of the series of eight proven techniques for investing in real estate. This week we are going to look at a technique that is still very passive from the management side but a little more complicated. That techinique is: Investing in Real Estate Notes. Definitions: Promissory Note: A signed document that contains a legally enforceable promise to pay a stated sum to a specified person at a specified time.

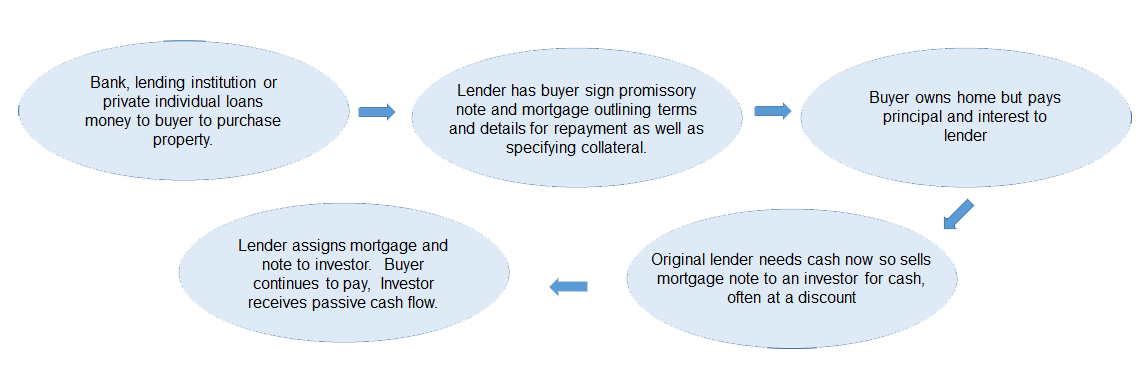

How it works: This chart shows the simple basics of how a note investing transaction would occur: How to invest:

There are five primary sources for purchasing notes:

Pros:

Where to get more information: Bigger Pockets Blog Udemy.com Next week we explore how you can become the bank through the lucrative technique of Private Lending. Please reach out to me with any questions or comments using the comments button or through the contact page on my web site. If you would like to talk more about any of these investment methods or discuss how we can partner together, please contact me.

0 Comments

Leave a Reply. |

RSS Feed

RSS Feed