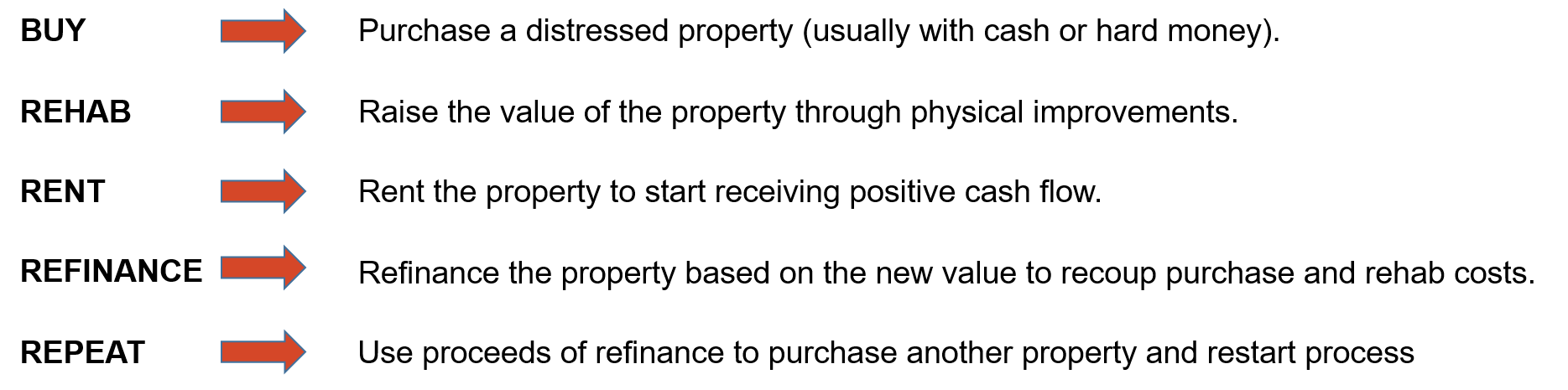

In week seven we went through the basics of a Fix and Flip operation. This week we get to talk about one of my all time favorite real estate investing techniques. Imagine if you could invest in something that would return the money you invested to you but still continue to pay a return. Essentially, you would be getting an infinite return on your money since you would be getting a return on a zero dollar investment. What if you could take that capital and keep doing the same thing over and over creating multiple streams of passive cash flow out of the same chunk of capital. Well that is exactly what the BRRRR strategy is all about. Let me explain how it works. Definitions: BRRRR - BRRRR is an acronym for Buy - Rehab - Rent - Refinance - Repeat ARV - After Repair Value (ARV) is the estimated value of the property after all of the renovations are completed. The ARV value is based on comparable sales (comps) in the same neighborhood. LTV - Loan to Value (LTV) is the term that lenders use to define the total amount of money they will loan against the total value of a property. Example: If a lenders maximum LTV is 80%, they will loan $80,000 against a property that is appraised at $100,000. Cash Out Refi - A cash out refinance is when you get a loan on a property that pays any money left over after paying existing loans directly to you. Seasoning Period - The seasoning period is the amount of time a lender requires between the time the property was purchased and when they will allow a refinance. This period varies depending on the lender with some local credit unions not even having a seasoning period to larger banks that might require 6-12 months. How it works: The key concept in a BRRRR strategy is getting your original investment back through a refinance of the property. Once the property has been fixed up and rented, the value should be high enough that you can do a cash out refinance to recover your purchase and rehab costs. The rent should still be enough to cover the new mortgage payment associated with the refinance and provide some additional cash flow. When this all works out perfectly, you are essentially receiving a monthly cash flow stream from zero dollars invested. You can then take the cash received from the refinance and use it to purchase and rehab another property, starting the cyle over again. Most banks will only loan 70% - 80% of the properties fixed up value (ARV) so you need to be diligent on the front end to ensure that you will have enough value in the property to get your funds back. You also need to make sure that the rents from the property will be enough to cover the after-refi mortgage payments and still provide cash flow with all the expenses subtracted. How to invest: Investing in a BRRRR project is just like a combination between a buy-and-hold and a fix-and-flip. You need to find a really good deal on a property that will allow you to add value to it so that you can refinance to get your purchase and rehab costs out. The general rule of thumb is that you need to purchase for less than 70% of your ARV less rehab costs. You will also want to line up a lender in advance since cash out refinances can be harder to execute. A good team consisting of a realtor, a contractor, a property manager, and a lender should be able to help you through the process.

Pros:

Cons:

Where to get more information: Bigger Pockets Guide to BRRRR Investing Fortune Builders - BRRRR Strategy Conclusion: The reason that I am a huge fan of the BRRRR strategy is it's ability to allow you to scale your portfolio quicker with limited capital. Even if things don't go perfect and you have to leave a little money in the deal, the returns can be much higher and you can continue to invest with the returned capital. Next week we will close out the Eight Proven Techniques with Syndication. Syndication is basically pooling investor money to purchase investments that might be too big for an individual and then splitting the profits among the partners. Please reach out to me with any questions or comments using the comments button or through the contact page on my web site. If you would like to talk more about any of these investment methods or discuss how we can partner together, please contact me.

0 Comments

In the last post we went over a great technique to get started in real estate investing with limited funds. If you haven't already read it, check out the good and the bad of Wholesaling. In this addition we are going to dive into another technique that most people are somewhat familiar with. Fix and Flip is the "sexy" technique that has spawned a plethora of TV reality shows and brand building moguls. While fix and flips can be profitable and fun, there is a lot going on that the TV shows aren't showing you. Let's take a look at the basics. Definitions: Fix and Flip - Fix and flip investing is simply the act of purchasing a property, renovating it, and then selling at a profit. ARV - After Repair Value (ARV) is the estimated value of the property after all of the renovations are completed. The ARV value is based on comparable sales (comps) in the same neighborhood. Holding Costs - Holding costs are the expenses related to holding on to the property during the rehab and sale period. Holding costs would include such things as; property taxes, insurance, loan payments, utilities, and lawn care. How it works: To accomplish a successful fix and flip project, you must be able to sell the property for a greater amount than your "all-in" costs, which are the purchase price, rehab expenses, and all holding costs. Obviously, this starts with purchasing a property at a discount compared to what other comparable properties that have already been rehabbed are selling for. You can then either perform the rehab work yourself or hire a contractor to tackle the job. Once the rehab project is completed, you will list the property at it's ARV value which should provide you with a nice profit upon sale. A general rule of thumb is that your purchase price should not exceed 70% of the ARV less the rehab costs. For example, if rehabbed comparable properties in your neighborhood are selling for $120,000 and the estimate to rehab your property to the level of those properties comes in at $20,000, you shouldn't pay more than $70,000 to purchase it: $120,000 ARV less $20,000 rehab costs $100,000 x70% $70,000 max purchase price The 30% that is left should cover your holding costs, selling expenses, and profit. As you can see, margins can get pretty tight especially if holding costs are high and/or the property doesn't sell right away. These are the little details that they usually forget to disclose on the TV shows. How to invest: There are many ways to work the details of a fix and flip project, but in general you need a plan around:

Where to get more information: Download from Bigger Pockets How to Flip Houses: The Ultimate Guide How to Flip a House: A Step by Step Guide for Soon To Be Succesful House Flippers As we near the end of our Eight Proven Techniques we will go over the BRRRR strategy next week. This is one of my favorite real estate investing techniques that really blew my mind the first time someone explained it to me. Please reach out to me with any questions or comments using the comments button or through the contact page on my web site. If you would like to talk more about any of these investment methods or discuss how we can partner together, please contact me. |

RSS Feed

RSS Feed