The "Law of the First Deal" is a real estate term that is used to describe the importance of getting your first deal done and allowing the momentum to grow from there. The first deal can be the hardest and most intimidating but the learning experiences, team building, and mental breakthrough of taking action can be a game changer, allowing you to exponentially grow your real estate portfolio from there. The big question is how to get started with that first deal. I talk to people almost every day that are working toward their first deal by trying to utilize a more advanced and/or technical strategy. While most of these strategies are valid ways to invest in real estate and are being done successfully by seasoned investors, my advice is to Keep It Simple Stupid (K.I.S.S) for your first investment and learn from there. Build experience, grow your team, network with others, and grow into these other strategies. So many people are taking courses and listening to "gurus" that tell them to be successful you need to employ the latest "secret" or "buy with none of your own money". For example, I constantly talk to people that have never purchased, managed, or sold an investment property, yet they tell me that they are working toward syndicating 100+ apartment complexes with none of their own money. Don't get me wrong, I think syndication can be a great strategy for experienced investors that know what they are doing. But honestly, who wants to invest their money with someone that has zero experience, what broker is going to take a multi-million dollar offer from a total newbie very seriously, what bank is going to loan to someone with none of their own money or experience. I'm not saying it can't be done but you are going to need a substantial network of people that trust you and partners that can supply the experience and net worth required to pull off a large syndication. Here's a better idea (in my opinion) - For your first investment, utilize a strategy that can get you in the game quicker and build momentum from there. A few of the easiest, albeit not sexiest ways to get started include:

0 Comments

We all see the headlines every day reminding us about crazy the current real estate markets are. With few exceptions, prices and rents are appreciating at record rates, homes are getting scooped up as soon as they are listed, and buyers are bidding up prices far exceeding asking prices. How long can this last? When do we hit an affordability ceiling? What happens next - do we freefall back to 2008 prices? Every real estate guru is telling us something different but the truth is that they have no idea either. No one wants to buy at the top and immediately see their equity plummet due to a sharp decline in values, but I prefer to think about my investments over a longer time horizon that will ride out the highs and lows to provide me with long term wealth. Every day I talk to someone that tells me they are "waiting on the sidelines" to jump in and purchase all of the great deals that are going to come when the market crashes. Maybe they will get it right and be able to say "I told you so", but here is one perspective on the cost of getting it wrong that uses pretty basic math. For this simplified example, let's say that I am looking at purchasing a single family home in the Denver market. Denver has seen crazy appreciation, averaging about 1.5% per month recently. I don't expect that to be sustainable but do think that it is possible to continue seeing around 1% per month for another year before things drift back to a more normalized 3%-4% annually. The other elephant in the room is interest rates. Rates don't really have anywhere to go but up. We don't know when or how much they will go up but most analysts believe that we will be back in the 4s by this time next year. With those basic numbers, let's look at the difference between purchasing now and waiting for the "crash". Buy now: Purchase price - $500,000 Down payment (20%) - $100,000 Loan amount - $400,000 Interest rate - 3.0% Monthly Principal and Interest payment = $1686.42 Buy in 12 months: Purchase price (1% per month appreciation) - $560,000 Down payment (20%) - $112,000 Loan amount - $448,000 Interest rate (assuming a rise of 1%) - 4.0% Monthly Principal and Interest payment = $2138.32 As you can see waiting 12 months for a market correction that never comes means that you will need to come up with an additional $12,000 for the down payment and an extra $451.90/month. Over the term of a 30 year mortgage, this adds $162,684 to the cost. Since rents typically increase slower than prices, this will really cut into your cash flow. Let's say you actually get it right and real estate prices do see a 10% decline prompting you to jump in and scoop up a "deal". For those of you thinking that the market will decline by way more than 10%, I just don't see it. Even during the 2008 meltdown, statistics show that the Denver metro area declined by 7%-13% before stablizing. Buy in 12 months with 10% market correction: Purchase price (appreciated price less 10% correction) - $504,000 Down payment (20%) - $100,800 Loan amount - $403,200 Interest rate (assuming a rise of 1%) - 4.0% Monthly Principal and Interest payment = $1924.24 As you can see the effect of rising interest rates and strong appreciation cancels out a decline in market prices for this example. You would still see a monthly payment increase of $237.82 per month equating to $85,615 over the course of a 30 year loan. Of course, there are many different scenarios that could play out and the actual numbers will depend on what really happens with interest rates, appreciation rates, and timing of all factors. My point is more about looking at the numbers from all perspectives and aligning your strategies with your goals and time horizons. Don't just make your buy/sell decisions based on what the media and real estate gurus are pumping out in the headlines to attract attention.  One of the great debates that I hear constantly among my investor friends and colleagues is the argument of stocks vs real estate. I am going to use a very realistic example below to show why based on historical averages and pure return numbers, real estate is the clear cut winner. Now, I'm not saying stocks are bad and that you shouldn't invest in them. They have the advantage of being very liquid, easy to invest in, and a good way to diversify. What I am saying is that dollar for dollar, real estate is going to provide a quicker path to wealth than the stock market. The number one reason that I can say this with confidence can be summed up in one word - LEVERAGE. Let's take a look at what I mean. For this example let's assume that I have $100,000 to invest and a 15 year time horizon. A March 2021 article in the Motley Fool shows the historical returns of the S&P 500 at 9% and the average US home appreciation rate since 1940 has been 5.5%. Wait a minute, didn't I say that real estate provided better returns? This is where that leverage part comes in. Stocks:

Real Estate:

Sure, this is a bit of a simplified example but I did use very realistic numbers that reflect long term historical averages. There are probably arguments over expenses, fees, and other small details. If the numbers were remotely close, I would say - "let's dig deeper" and see if the advantage switches. But this isn't even close so it would take a lot of "ifs, buts, thens" to turn this around. Plus the cherry on top of collecting passive cash flows from rents once the asset is paid off makes real estate the no brainer choice for me.  Today I would like to dispel what I think is one of the greatest myths in real estate investing. There will no doubt be many who disagree with me and will say that I am an idiot, but bear with me until you see the numbers. Of course, people have different goals and reasons for investing so some of those that disagree me will be correct for their specific situation. The great myth that I am referring to is: "Invest for cash flow not appreciation. Any appreciation is just gravy on top of the cash flow." This statement has been worded in many different ways but in some form or another is drilled into beginning investors by the gurus as gospel. I truly believed in this for years until really delving into the financial returns of my investments and realizing that appreciation was the largest driver in BUILDING WEALTH. Monthly cash flows are great for creating passive income and allowing you to retire from your W2 job but if you have a longer view of things and are trying to build true wealth, I would say invest for appreciation and the cash flows are the gravy on top. Another way of looking at is; cash flows are how you hold on to the property but appreciation is how you make your money. Let's look at a quick example to illustrate why I believe this to be true. Two markets that I have some experience with are Memphis, TN and Denver, CO. Memphis is known for it's affordable, high cash flow properties. Denver is known for it's high prices and difficulty cash flowing. Memphis:

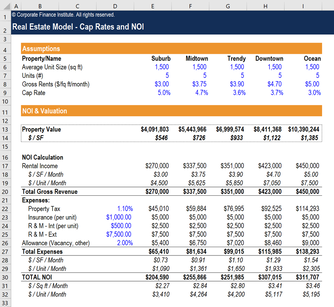

This is a very simplified model and does not include things such as rent increases, depreciation and many other factors but the point is that it takes a lot of those $230/month cash flows from the Memphis property to make up for the huge difference in appreciation of $316,665. Personally, I would still never invest in a negative cash flow property but am willing to take a lower cash on cash return since my time horizon is longer and I feel confident in choosing markets that will continue to outpace the national average of home price appreciation. If you need the money now, the higher cash flows are your best bet, if you have a longer time horizon to build wealth, look at the long term market appreciation.  In Part 1 of What Are All Those Acronyms? we went over six very important financial measures used to analyze the performance of a real estate investment. This week we will go over six more acronyms and their formulas, including the one that I think is the most important measure of the bunch. Understanding these terms and what they mean makes the difference between a newbie investor and someone that is able to truly look at a deal for it is worth. ROI - Return on Investment = ROI is probably one of the most used terms in analyzing investments. This measure is relevant across all asset types and classes. It measures the income or gain on the investment as a percentage of the investment cost. There are two widely used formulas for ROI. Net Income/Cost of Investment or Investment Gain/Cost of Investment ROE - Return on Equity = ROE is very similar to ROI but instead of using the cost of the investment, your income or gain is divided by the equity. In the case of stocks, equity would be the shareholders equity (companies assets less debts). In real estate equity would be the value of the property less any debt on the property. This is a good one to watch when holding investments for a longer period because as the equity increases (through appreciation or debt paydown) the ROE will decrease. As the ROE decreases, it is often wise to find ways to re-invest the equity at a higher ROE. Net Income/Equity LTV - Loan to Value = LTV is a term that you will most often encounter when applying for a mortgage. It is simply the percentage of the loan amount to the value of the house. Loan Amount/Value of Property DCR - Debt Coverage Ratio = DCR is another ratio that lenders that will look at when you are taking out a loan on an investment property. The DCR is the percentage of the annual debt service that is covered by the annual net operating income. In simplified real estate terms: how much of the mortgage payment is covered by the rental income (hopefully at least 120% for most lenders) Net Operating Income/Total Debt Service OER - Operating Expense Ratio = The OER is a measurement of how much it costs to operate a property compared to the income provided by the property. It is the percentage of operating expenses to the gross revenue. Total Operating Expenses/Gross Revenue TER - Total Equity Return = I saved the best for last! In my opinion, the Total Equity Return on an investment is the best measurement when comparing properties. TER captures the return from the cash flow, the appreciation, and the paydown of the loan compared to the original cash invested. Some markets might see great cash flow but no appreciation while others might appreciate rapidly but see very little cash flow. The Total Equity Return is a great way to measure the best blend of cash flow, appreciation, and leverage to maximize your overall wealth creation. (Annual Cash Flow + Annual Asset Appreciation + Annual Paydown of Debt)/Initial Cash Invested All of these calculations will give you a slightly different look at an investment's performance or help you in underwriting the deal to see how it is expected to perform. It isn't really necessary to memorize the formula for each one but at least have a spread sheet that will calculate the metrics based on your inputs of the variables. This allows you to compare different investments and ensure that you are on track to meeting your goals. After you analyze enough deals, you will get good at "ballparking" some of the important calculations to see if it is worth your time to delve deeper into the deal.  If you have been looking at investment properties, you have probably seen a whole list of letters such as NOI, IRR, CoC, etc. listed in the marketing packages. These are all acronyms for various economic return variables that are used to compare investments. If you have gotten to my blog, you probably know the meaning of at least some of these, but here is a quick list and explanations for the most commonly used terms. We're going to split this into a two part series to keep our brains from melting due to mathematical overload. GOI - Gross Operating Income = GRM is simply how much income the investment brings before any expenses or debt service are subtracted. Potential Rental Income - Vacancy & Credit Loss =Effective Rental Income + Other Income = Gross Operating Income NOI - Net Operating Income = NOI is the Gross Operating Income minus all of the operating expenses. NOI does not take into account debt service so this number is before your mortgage payment is made. Operating expenses are all of the expenses (except debt service) that are incurred to operate the properties. These include; insurance, taxes, utilities, repairs & maintenance, management, etc. Gross Operating Income - Operating Expenses = Net Operating Income CCR (or CoC) - Cash on Cash Return = CCR is a measurement of the investments performance or the yield on the cash that you have invested. CCR is a relatively good metric for comparing investments across different asset classes, i.e. stocks compared to real estate. It is the percentage of pre-tax cash that you earn on the amount of cash you invested. CCR = Annual Pre-tax Cash Flow/Total Cash Invested IRR - Internal Rate of Return = IRR is another measurement of the investments performance. IRR is often the gold standard of comparison between different investments because it takes in to account the initial investment costs, cash flows, and sale proceeds. So instead of just looking at the monthly cash flows you get a better measurement of the overall profitability or loss. A higher IRR is better. The IRR calculation is complicated enough that it is best left to a financial calculator or computer program where you input the data and it spits out the IRR number. Cap Rate - Capitalization Rate = Cap Rate is probably the most used analysis term in real estate. Personally, I think cap rates are a little over-rated because they don't factor in items such as equity growth through appreciation and paydown of the loan, but I'll save that argument for another day. The cap rate is simply an estimate on your returns used to compare different properties or markets. As cap rates go up, the return on your investment goes down (when you are the seller). As a buyer, you want a higher cap rate. Cap Rate = NOI/Property Value or Cost GRM - Gross Rent Multiplier = The easiest way that I have found to explain GRM is that it is the number of years of gross income that it would take to pay for the property in full. So if a property is listed for $500,000 and the annual gross income is $100,000 the GRM would be 5. There may be a few caveats to that definition but here is the formula: GRM= Market Value/Annual Gross Income It is very important to understand these numbers and how to calculate them. Even if you don't start out memorizing all of the formulas, write them down somewhere or create a spreadsheet with the formulas. Knowing the metrics is the key to successful investing and without a working knowledge of these comparison tools, you are blindly searching for a good property. Next week we'll go over six more important calculations and you'll be on your way to becoming a underwriting master mind!  I think that most people will agree; losing hard earned money in a bad investment is a very painful experience. There is a strong stigma that goes along with coming out on the wrong side of the equation so we tend to take it very personally and do everything possible to avoid a negative outcome. Warren Buffett is quoted as saying "There are only two rules to investing: #1 Don't lose money; #2 Never forget rule #1. While I absolutely agree with the principal that losing money is not an outcome to strive for and you should take extraordinary efforts to MAKE money, I think that is worth reconsidering our reaction to losing money. If you are in the investing game long enough, you are bound to rack up some war stories of getting thumped and facing some financial setbacks. The big difference between mega-successful investors and those that are flatlining along is how they react to these losses and continue to move forward. Here are my recommendations on how to pick yourself up and actually improve yourself after suffering an unexpected loss.

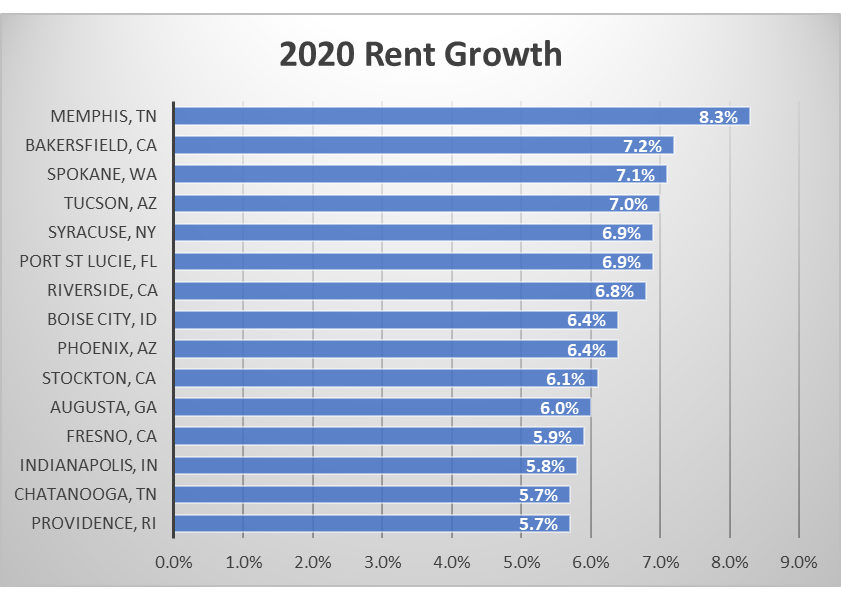

For most people 2020 had it's fair share of challenges. Covid 19 created economic turmoil that resulted in an unemployment spike, increased deliquency rates, and decreased rental collection rates. In most parts of the country rents stayed fairly flat or the rates at which they were increasing slowed but there were still metro areas that saw huge average rental price gains. As with home prices, rental rates are really determined by the supply/demand ratio. When supply exceeds demand, rates decline. When demand exceeds supply, rates rise. This supply and demand dynamic happens on a very localized level so it is important to dig in to the details and see what is causing the rates to increase or decrease and exactly where it is happening. To say that Memphis, TN saw an 8.3% rise in rental rates does not mean that if you own a property in Memphis you can increase your rents by that much and be competitive. You need to know specifically what neighborhoods and types of properties are seeing the increased demand. Then look to the edges and see where you can purchase properties in the path of progress.

With all of that being said, here is the macrodata on the top 10 rent growth metro areas in 2020. This data comes from Zillow so take it with a grain of salt as the saying goes. I am happy to be operating in 3 of these top 10 markets and have definitely benefited from rising rents. Now that we are finally getting some clarity into the political environment over the next 4 years, questions are arising about what the new administration and Congress will mean for real estate investors. There is a lot of talk about Joe Biden and the Democrat controlled Congress eliminating the 1031 Exchange for real estate investors. This got me thinking more about the 1031 Exchange process and how beneficial it actually is. This post will leave politics on the side and just focus on what a 1031 Exchange is and some of the requirements to transact the exchange.

What is a 1031 Exchange? The most basic definition of a 1031 Exchange is the swap of one investment property for another investment property that allows capital gains taxes to be deferred. How does it work? To complete a 1031 Exchange an investor would engage the services of an agency that is authorized to handle the transaction. During a 1031 Exchange the investor decides to sell a property and use the proceeds to purchase another "like kind" investment property. The agency handling the transaction will manage the transfer of funds to ensure that the investor never takes possession of the money since that would nullify the tax deferral. What is the fine print? As with anything that allows for a tax reduction or deferral, there are some rules to follow. Here are a few high level requirements for a 1031 Exchange. Definitely engage the help of a 1031 professional before trying to do this.

What are the timing requirements? There are some very specific timing requirements to legally transact a 1031 Exchange.

What are the financial benefits of a 1031 Exchange? The financial benefits of a 1031 Exchange are quite astonishing! The current capital gains tax rate for most investors is going to be 15-20%. So in essence each time you exchange up you have 15-20% more money to invest that would have otherwise been paid to the IRS at the sale of your previous property. Example: Assume that you have an investment property that you bought for $400,000 and you are selling for $500,000. In a normal transaction, you would pay $20,000 in taxes and have only $480,000 to invest in your new property. With a 1031 Exchange, you get to invest that full $500,000. Where it starts to really get good is when that new property appreciates. If your new property appreciates by 10% the 1031 exchanged property would be worth $550,000 while the normally exchanged property would only be worth $528,000. Do this a few times and the difference really starts to add up. An extreme example of this technique is how George Soros used a similar tax advantage to reinvest investor fees in his fund rather than pay taxes at the time the income was earned. Had he paid the taxes when the income came in and only reinvested what was left, his original $18 million would have grown to $2.4 billion. Instead, that original $18 million has grown to approximately $12 billion!! I don't think anyone will scoff at earning an additional $9.5 billion. Will you ever have to pay taxes on these earnings? Yes, the 1031 Exchange is a tax deferral technique, not a tax elimination. Eventually, you will have to pay the piper and settle up with Uncle Sam. There is still a great advantage here because you are growing your net worth at a significanty increased rate. Even when you settle up, you should have way more money in your pocket. There are advanced estate planning techniques to step up the basis on these investments when passing on to heirs and thus minimize taxation but that is a whole separate topic. Conclusion You may have thoughts and beliefs on the appropriateness of these tax provisions and whether to utilize them or not. Whatever you decide is best for you, it is important to at least know what options are available and make the best possible decisions.  I have gotten some positive feedback on recent posts about topics on mortgages and basic personal finance so would like to throw a few more posts out there keeping this theme. This week let's look at the difference between a 15 year mortgage and a 30 year mortgage. Most of us understand the basic difference being that a 15 year mortgage generally has a lower interest rate but higher payment due to the shorter amortization period (length of time to pay off). There is a lot of mixed advice out there regarding whether the 15 or 30 year mortgage is better. Some sources highlight the lower total interest cost of a 15 year mortgage and the quicker buildup of equity. Other sources say always take the 30 year mortgage for the lower payment and pay extra when you can. As with most financial advice, there isn't a definitive right or wrong. Each individual's best path will be determined by their financial goals, risk tolerance, and personal situation. This analysis is merely a hypothetical scenario to see what the actual differential in costs would be to allow you better insight as to which choice might be right for you. In this scenario, we'll use realistic numbers based on where the markets currently are in December 2020. Here's the scenario: Jack and Jill are looking to purchase their first home and trying to make sense of the numbers. The house that fell in love with is a 3 bedroom / 2 bathroom home in the suburbs. They have saved up some money for a 20% down payment and are trying to choose a mortgage. Home Price = $319,000 (median national home price in 2020) Down Payment (20%) = $63,800 Mortgage Amount (Home Price less Down Payment) = $255,200 They have been offered the following interest rates (for simplicity, I am not including points, fees, etc,) 30 year fixed mortgage = 2.9% 15 year fixed mortgage = 2.3% Based on the loan amount, interest rate and loan period, their Principal and Interest payments would be: 30 year mortgage payment = $1,062/month 15 year mortgage payment = $1,678/month At this point, the big question becomes; do Jack and Jill want to pay $616/month to get their home paid off in 15 years instead of 30 years. Obviously, this will depend on their goals and current financial ability to pay the higher payment. But what if they took the 30 year mortgage and paid the 15 year mortgage payment, applying the extra payment amount to reduce the principal but reserving the option to pay the lower payment if they ran into some difficulties or needed those funds for a better opportunity? 30 year fixed rate loan with additional $616/month principal paid Loan Payoff = 190 months (15 years and 10 months) Total Interest Paid = $63,280 15 year fixed rate loan with $0 additional principal paid Loan Payoff = 180 months (15 years) Total Interest Paid = $46,790 With the true numbers in front of them, Jack and Jill can now make an educated decision as to what is best for them. If they think that making the higher payment could become difficult in the future then the 30 year loan makes more sense even though the overall cost of doing so will be $16,500 over the life of the loan. Another argument that I like to consider is the opportunity cost of the funds used to make the higher payment of the 15 year mortgage. Borrowing money at 2.9% (30 year loan) is so cheap that I don't mind paying the additional interest in order to keep $616 per month in my pocket to invest elsewhere. My other investments can easily earn a minimum of 8-10% per year (often much higher than this) so it makes sense to invest that extra money, pay the mortgage loan interest, and keep the profits cycling into new investments. By having a well thought out financial plan and taking a little time to run through the calculations, decisions like choosing a mortgage term become much easier. Compare the outcomes of different variables to see how they align with your goals and you can jump with confidence. Next week I will analyze the potential earnings of investing that $616/month savings and compare that to the additional interest cost of the 30 year mortgage. |

RSS Feed

RSS Feed