Last episode we took a look at how to invest in REITs, real estate mutual funds and ETFs as part of the series of eight proven techniques for investing in real estate. This week we are going to look at a technique that is still very passive from the management side but a little more complicated. That techinique is: Investing in Real Estate Notes. Definitions: Promissory Note: A signed document that contains a legally enforceable promise to pay a stated sum to a specified person at a specified time.

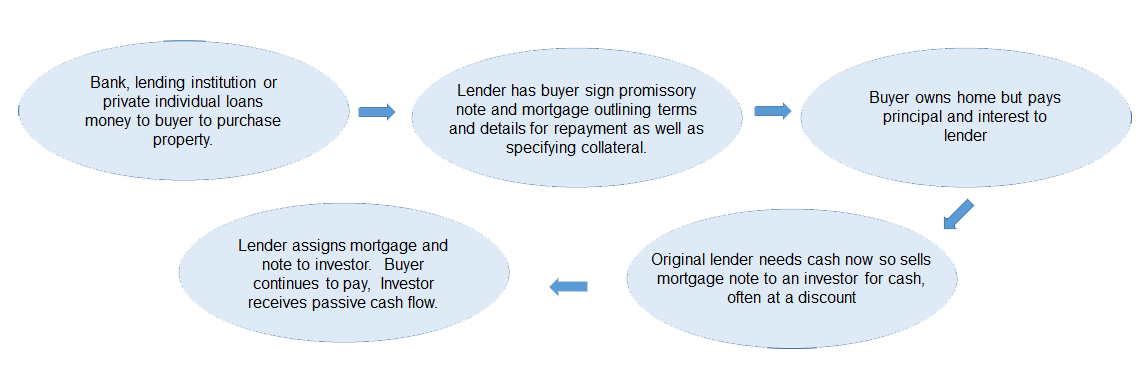

How it works: This chart shows the simple basics of how a note investing transaction would occur: How to invest:

There are five primary sources for purchasing notes:

Pros:

Where to get more information: Bigger Pockets Blog Udemy.com Next week we explore how you can become the bank through the lucrative technique of Private Lending. Please reach out to me with any questions or comments using the comments button or through the contact page on my web site. If you would like to talk more about any of these investment methods or discuss how we can partner together, please contact me.

0 Comments

This week we will kick off our Eight Proven Techniques for Investing in Real Estate series with a more detailed look at Real Estate Investment Trusts (REITs), Real Estate Mutual Funds, and Real Estate Exchange Traded Funds (ETFs). These three techniques are very passive, meaning that once you purchase the investments, there is very little effort needed on your part to manage the asset(s).

We will follow a similar format for each of the eight techniques in the series so here we go: Definitions: Real Estate Investment Trust (REIT) - A company that owns and sometimes operates income producing real estate such as apartments, warehouses, self storage facilities, malls, hotels, etc. Real Estate Mutual Fund - An actively managed fund of multiple REIT firms. Exchange Traded Fund (ETF) - A passively managed group of REIT firms generally based on an index. How it works: REIT - A Real Estate Investment Trust (REIT) is basically a corporation that owns and operates real estate assets that are purchased using capital raised from selling shares in the corporation to investors. The REIT generates income from rents, capital gains, and mortgage interest and is required to return at least 90% of taxable income back to the investors in the form of dividends. An easy way to think of it is as a middleman that pools lots of investors money to purchase large real estate assets and then returns most of the income to those investors. The REIT itself makes money through some more complicated accounting principles such as Funds from Operations (FFO). Basically, the taxable income that has to be returned to investors is less than the actual positive cash flow due to factors such as depreciation. Some of the FFO may be returned to investors as dividends and the rest is used to fund the corporate operations and purchase more assets. There are three primary types ot REITs.

Real Estate Mutual Fund - A real estate mutual fund is simply a fund with a group of REIT stocks inside of it. These provide greater diversity and potentially less risk since a professional actively manages the group of REIT stocks. Real Estate ETF - Like a real estate mutual fund, an Exchange Traded Fund (ETF) is a fund with a group of REIT stocks inside of it. The big difference is that ETFs are not actively managed , meaning that the REIT stocks inside of the fund mimic an index and remain the same. There are many indexes for sectors such as residential, commercial, European, North American, etc.. ETFs also trade slightly different as they are bought and sold in real time on the markets instead of being closed out at the end of a trading day like a mutual fund. How to invest: REITs, Mutual Funds, and ETFs are extremely simple to invest in since they are traded on the public markets. There are private REITs but we will save those for another day. A public REIT stock can be purchased and sold through your broker just like any other stock. It is wise to do some research or work with your financial planner to ensure that you purchase an interest in a REIT that matches your investment profile. Pros:

Cons:

Where to get more information: If REITs, Mutual Funds or ETFs sound like your kind of investment, here are a few sources to get more information and get started on your journey to financial freedom through real estate: Investor.gov REIT.com Nerdwallet.com Next week we will dig into the world of Real Estate Notes to see how they work and if they are right for you. Please reach out to me with any questions or comments using the comments button or through the contact page on my web site. If you would like to talk more about any of these investment methods or discuss how we can partner together, please contact me.  Investing in real estate is one of the greatest wealth building activities one can engage in. According to a Feb. 2020 report from the College Investor, over the last two centuries about 90% of the world's millionaires have been created by investing in real estate. Unfortunately, many investors never utilize this profitable avenue because they have heard horror stories about tenants, toilets, and termites. They think that real estate investing is all about getting late night calls for backed up toilets or dealing with unscrupulous tenants that don't pay rent. Taking a closer look at real estate reveals that there are many different ways to participate ranging from extremely easy and passive to full time employment commitments. Over the coming weeks, I will take a deeper dive into eight proven techniques and discuss the advantages vs. disadvantages of each. The goal is to get you thinking about which technique makes the most sense for you based on your commitment, goals, risk tolerance, and personal situation. The question should not be "should I invest in real estate?", but rather, "how should I invest in real estate?". Here is an overview of eight popular and proven techniques. Follow along in coming weeks as I dig deeper into each.

|

RSS Feed

RSS Feed