You may hear the terms debt partner and equity partner thrown around when working with other investors on a joint deal. What are the differences between these two partnership structures and which one is better? Here is a quick overview of these two ways to partner on a real estate investment. DEBT PARTNER: A debt partner is someone who loans money to someone else for an investment in return for an agreed upon interest rate until the debt is repaid. The debt partner has no ownership stake in the investment but the property is generally used as collateral through a promissory note and mortgage. If the borrower defaults on the loan, the debt partner can foreclose and take ownership of the property. Example: Jim finds a great deal on a single family home that can be rehabbed and flipped for a substantial profit but he doesn't have enough cash to purchase the property and fund the rehab. He reaches out to his friend Mary who has a nice nest egg sitting in the bank earning very little interest. Mary agrees to loan Jim $100,000 at 8% interest for 12 months. They have an attorney write up the proper documents and purchase the property in an all cash deal using a reputable title company. Jim gets to work on the rehab which takes 3 months to complete and another month to sell the property to a happy new family. During each of these 4 months, Jim pays Mary $666.67 in interest (($100,000 * 8%)/ 12 months). At the sale of the property Jim also pays Mary back her $100,000 original investment but keeps 100% of the remaining profits from the flip. They are now free to go their separate ways or look for another deal to partner on. EQUITY PARTNER: An equity partner is someone who is a partner in an investment where they have an actual ownership in the investment. An equity partner may or may not have a voice in the decision making depending on the Operating Agreement of the partnership. Equity partners generally participate in both the upside and downside of an investment. Example: Using the same example as above, Jim finds a great flip opportunity that will need $100,00 to purchase and rehab. Since he only has $60,000 in cash available, he reaches out to Mary to see if she is interested in becoming a partner and chipping in the other $40,000. Mary agrees so they have an attorney write up their new LLC documents with Jim being a 60% owner of the LLC and Mary being a 40% owner of the LLC. The LLC Operating Agreement lays out the roles and financial expectations for each partner. The property is purchased in the LLC's name. Jim manages most of the day to day operations on the flip and the property sells for $150,000 4 months later. Per their Operating Agreement, Jim receives 65% of the proceeds and Mary receives 35% of the proceeds. The reason it is not 60/40 per their original investments is because Mary agreed to give Jim an extra 5% for managing the project since she has a full time job and didn't have time to be involved in all of the details. The LLC can now be dissolved or Jim and Mary can take their funds and invest in another deal. Which is better? There is no right or wrong answer to which is better. Every investor has their own set of criteria, goals, risk tolerances, and preferred way of doing business. In general, a debt partnership is simpler and contains less risk but doesn't have as much potential upside. I like to start working with people using a debt structure to build up confidence and see how well we work together. These types of partnerships also allow me to "cash out" a partner easier and more quickly should the need arise. Equity Partnerships are preferred when the investment is going to be a longer term or when taking down larger deals where a pool of investors is required. These arrangements often have a greater upside since equity partners share in the profits from the investments but carry more risk and are much harder to cash out before the business plan is fully executed. If you are interested in learning more about partnership structures or how we can work together to meet your financial goals, reach out anytime via the contact page at jbfoxcapital.com

1 Comment

If you have been paying attention to any financial news lately, I am sure that you are aware of the historic low interest rates right now. In a report released last week by Freddie Mac (Federal Home Loan Mortgage Corporation), they announced that rates recently hit an all time low. The average interest rate for a 30 year fixed mortgage dropped to 2.86% last week and the average 15 year fixed mortgage was 2.37%. For those of you that haven't been around long enough to grasp the magnitude of how low those rates are, consider that in 1981 the average 30 year rate was 16.63% and the 47 year average sits right at 8.0%. . What do those rates mean for a typical payment? Check out this chart showing the monthly principal and interest payment due on the same $250,000 loan at the high in 1981, the historic average, and todays rates: Principal and Interest payment for a 30 year $250,000 loan: @ 16.63% (1981) = $3,489 @ 8.0% (historic average)= $1,834 @ 2.86% (current rate) = $1.035 As you can see the interest rate makes a significant difference in the monthly payment. For the exact same house you would have been paying more than three times the current monthly payment in 1981 and 77% more based on the historic average. So is it time to refinance your current mortgage and take advantage of these all time low rates? People often ask me how to determine if it makes sense to go through a refinance. There are many factors that play into this decision but I will show you how I come to this decision on my properties. The process is a pretty simple mathematical break even analysis that goes like this:

Hopefully, this quick calculation will help you decide the value of a mortgage refinance. Please reach out with any questions or if I can help you determine the value of a refinance.  Since we are talking about IRS tax code today, I will start this post out with a quick disclaimer that I am not a CPA, or Tax Attorney, or other tax professional. Please don't take this information as tax advice as every persons situation will vary and tax laws change frequently, This is a compilation of information that I gathered while doing my own research on selling my primary residence. With that out of the way, let's answer the question; What is the Section 121 exclusion? Section 121 of the Internal Revenue Code allows a taxpayer to exclude up to $250,000 ($500,000 if filing a joint return) of the gain from the sale of property owned and used as a principal residence for at least two of the five years before the sale. This can be a massive tax savings when selling a property that has appreciated greatly in value. Here are some of the fine print details of Section 121:

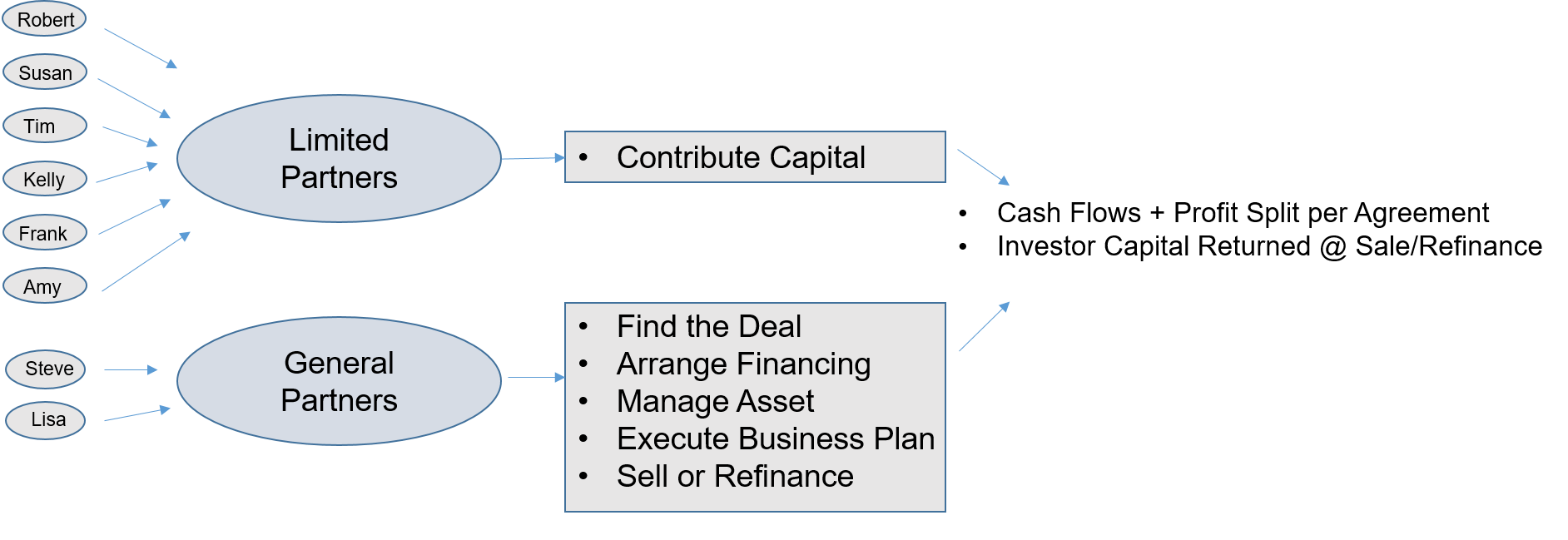

As always, please reach out to me via email or the comments section below with any questions or to discuss how we can work together to grow our financial futures through real estate investments.  Last week we covered a fascinating way to grow your portfolio rapidly with a limited amount of capital using the BRRRR Strategy. In our final week of the series we will go over a technique known as Syndication. Syndication is simply multiple investors pooling resources to purchase real estate investments. This is a great technique because it allows smaller investors to take part in very large deals that they couldn't do alone. Syndication also offers opportunities for people to invest as "Limited Partners" and stay passive in the process. This means you don't have to be a real estate, financial, or management expert to be part of a large transaction. There are many different ways to apply Syndication but we are going to focus on using this technique to purchase larger multifamily apartment complexes. Definitions: Syndication - Pooling capital with other investors for the purpose of purchasing a real estate asset. Most syndications consist of General Partners and Limited Partners. General Partner - A general partner in a syndication is an investor that is involved in leading the transaction. Most often the general partner(s) are the ones signing on any loan documents and making the management decisions to execute the business plan. Limited Partner - A limited partner in a syndication is an investor that contributes capital to the transaction in return for a portion of the cash flows and/or profits. Limited partners do not participate in the asset management or execution of the business plan. They are also protected from most of the risks like lawsuits, bankruptcy, etc.. Value Add - A value add strategy is one where an asset is purchased with the intention of adding value to it through a business plan usually consisting of increasing management efficiencies and/or increasing rents through remodeling of the property. Cap Rate - Cap rate is a metric frequently used in the multifamily real estate world to compare assets using the rate of return. The formula for cap rate is Net Operating Income/Asset Value. This means that the higher the cap rate, the more profitable the asset should be. Cash on Cash Return - CoC Return is another profitability metric often used in real estate. It is the ratio of cash income earned to the cash invested in the property. The formula is Annual Pretax Cash Flow/Total Cash Invested IRR - IRR stands for Internal Rate of Return and is considered one of the best metrics of an assets profitability. The IRR is a measure of return that takes into account all cash flows (both negative and positive) as well as the timing of those cash flows. The formula for IRR is pretty complicated so I recommend using a financial calculator or computer model to calculate (Excel can do this for you). How it works: There are different ways to structure a syndication but in general a group of General Partners locates an investment that they are interested in and then puts together an entity to purchase it. The entity (LLC, Corporation, etc.) will consist of two classes of ownership; the General Partners that will be responsible for handling all of the duties to purchase, manage, and sell the asset and the Limited Partners that will contribute capital towards the purchase but not be involved in the actual work involved. A legal agreement will be used to outline each partners duties, how the profits will be split and distributed, and any other important information. Most syndications will pay an agreed upon portion of the investments cash flow back to the investors and then profits will also be split upon completion of the business plan and sale of the asset. How to invest: To invest in a Syndication as a Limited Partner you will need to do some homework on reputable operators that are investing in the asset class you are interested in. If you are an accredited investor, meaning you have a net worth of $1,000,000 or more (not including your primary residence) and/or have earned more than $200,000/year for the past two years with the expectation of the same in the current year ($300,000 if filing jointly with a spouse), you can find syndicators advertising their opportunities online, on social media, and through other public methods. If you are not accredited, you can still seek out syndication operators through your own research, referrals, or networking events. The reason for the difference is that operators that publically advertise their opportunities can only accept accredited investors in their deals. In order to accept non-accredited investors, a syndication has to be set up to do so and can only accept investors that they have an established relationship with. While you don't need to be an expert in real estate, finances, or syndication to invest as a Limited Partner, it is very important that you understand the basics, research the operator, and ensure that the investment aligns with your strategy and goals. There is a ton of public information out there to study up on before handing over your funds for one of these investments. Pros:

What is Real Estate Syndication? A Complete Guide to Modern Real Estate Syndication Conclusion: Syndication is a great way to reap the benefits of investing in solid multifamily assets without having to come up with millions of dollars on your own or manage a portfolio of large apartment complexes. You can often get in as a Limited Partner for $25,000 - $50,000 and receive monthly or quarterly cash flow while waiting for the business plan to be executed and realize healthy profits along with the return of your original invested capital. Please reach out to me with any questions or comments using the comments button or through the contact page on my web site. If you would like to talk more about any of these investment methods or discuss how we can partner together, please contact me. |

RSS Feed

RSS Feed