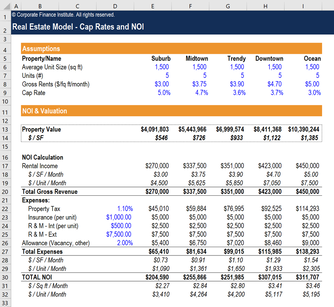

In Part 1 of What Are All Those Acronyms? we went over six very important financial measures used to analyze the performance of a real estate investment. This week we will go over six more acronyms and their formulas, including the one that I think is the most important measure of the bunch. Understanding these terms and what they mean makes the difference between a newbie investor and someone that is able to truly look at a deal for it is worth. ROI - Return on Investment = ROI is probably one of the most used terms in analyzing investments. This measure is relevant across all asset types and classes. It measures the income or gain on the investment as a percentage of the investment cost. There are two widely used formulas for ROI. Net Income/Cost of Investment or Investment Gain/Cost of Investment ROE - Return on Equity = ROE is very similar to ROI but instead of using the cost of the investment, your income or gain is divided by the equity. In the case of stocks, equity would be the shareholders equity (companies assets less debts). In real estate equity would be the value of the property less any debt on the property. This is a good one to watch when holding investments for a longer period because as the equity increases (through appreciation or debt paydown) the ROE will decrease. As the ROE decreases, it is often wise to find ways to re-invest the equity at a higher ROE. Net Income/Equity LTV - Loan to Value = LTV is a term that you will most often encounter when applying for a mortgage. It is simply the percentage of the loan amount to the value of the house. Loan Amount/Value of Property DCR - Debt Coverage Ratio = DCR is another ratio that lenders that will look at when you are taking out a loan on an investment property. The DCR is the percentage of the annual debt service that is covered by the annual net operating income. In simplified real estate terms: how much of the mortgage payment is covered by the rental income (hopefully at least 120% for most lenders) Net Operating Income/Total Debt Service OER - Operating Expense Ratio = The OER is a measurement of how much it costs to operate a property compared to the income provided by the property. It is the percentage of operating expenses to the gross revenue. Total Operating Expenses/Gross Revenue TER - Total Equity Return = I saved the best for last! In my opinion, the Total Equity Return on an investment is the best measurement when comparing properties. TER captures the return from the cash flow, the appreciation, and the paydown of the loan compared to the original cash invested. Some markets might see great cash flow but no appreciation while others might appreciate rapidly but see very little cash flow. The Total Equity Return is a great way to measure the best blend of cash flow, appreciation, and leverage to maximize your overall wealth creation. (Annual Cash Flow + Annual Asset Appreciation + Annual Paydown of Debt)/Initial Cash Invested All of these calculations will give you a slightly different look at an investment's performance or help you in underwriting the deal to see how it is expected to perform. It isn't really necessary to memorize the formula for each one but at least have a spread sheet that will calculate the metrics based on your inputs of the variables. This allows you to compare different investments and ensure that you are on track to meeting your goals. After you analyze enough deals, you will get good at "ballparking" some of the important calculations to see if it is worth your time to delve deeper into the deal.

0 Comments

If you have been looking at investment properties, you have probably seen a whole list of letters such as NOI, IRR, CoC, etc. listed in the marketing packages. These are all acronyms for various economic return variables that are used to compare investments. If you have gotten to my blog, you probably know the meaning of at least some of these, but here is a quick list and explanations for the most commonly used terms. We're going to split this into a two part series to keep our brains from melting due to mathematical overload. GOI - Gross Operating Income = GRM is simply how much income the investment brings before any expenses or debt service are subtracted. Potential Rental Income - Vacancy & Credit Loss =Effective Rental Income + Other Income = Gross Operating Income NOI - Net Operating Income = NOI is the Gross Operating Income minus all of the operating expenses. NOI does not take into account debt service so this number is before your mortgage payment is made. Operating expenses are all of the expenses (except debt service) that are incurred to operate the properties. These include; insurance, taxes, utilities, repairs & maintenance, management, etc. Gross Operating Income - Operating Expenses = Net Operating Income CCR (or CoC) - Cash on Cash Return = CCR is a measurement of the investments performance or the yield on the cash that you have invested. CCR is a relatively good metric for comparing investments across different asset classes, i.e. stocks compared to real estate. It is the percentage of pre-tax cash that you earn on the amount of cash you invested. CCR = Annual Pre-tax Cash Flow/Total Cash Invested IRR - Internal Rate of Return = IRR is another measurement of the investments performance. IRR is often the gold standard of comparison between different investments because it takes in to account the initial investment costs, cash flows, and sale proceeds. So instead of just looking at the monthly cash flows you get a better measurement of the overall profitability or loss. A higher IRR is better. The IRR calculation is complicated enough that it is best left to a financial calculator or computer program where you input the data and it spits out the IRR number. Cap Rate - Capitalization Rate = Cap Rate is probably the most used analysis term in real estate. Personally, I think cap rates are a little over-rated because they don't factor in items such as equity growth through appreciation and paydown of the loan, but I'll save that argument for another day. The cap rate is simply an estimate on your returns used to compare different properties or markets. As cap rates go up, the return on your investment goes down (when you are the seller). As a buyer, you want a higher cap rate. Cap Rate = NOI/Property Value or Cost GRM - Gross Rent Multiplier = The easiest way that I have found to explain GRM is that it is the number of years of gross income that it would take to pay for the property in full. So if a property is listed for $500,000 and the annual gross income is $100,000 the GRM would be 5. There may be a few caveats to that definition but here is the formula: GRM= Market Value/Annual Gross Income It is very important to understand these numbers and how to calculate them. Even if you don't start out memorizing all of the formulas, write them down somewhere or create a spreadsheet with the formulas. Knowing the metrics is the key to successful investing and without a working knowledge of these comparison tools, you are blindly searching for a good property. Next week we'll go over six more important calculations and you'll be on your way to becoming a underwriting master mind!  I think that most people will agree; losing hard earned money in a bad investment is a very painful experience. There is a strong stigma that goes along with coming out on the wrong side of the equation so we tend to take it very personally and do everything possible to avoid a negative outcome. Warren Buffett is quoted as saying "There are only two rules to investing: #1 Don't lose money; #2 Never forget rule #1. While I absolutely agree with the principal that losing money is not an outcome to strive for and you should take extraordinary efforts to MAKE money, I think that is worth reconsidering our reaction to losing money. If you are in the investing game long enough, you are bound to rack up some war stories of getting thumped and facing some financial setbacks. The big difference between mega-successful investors and those that are flatlining along is how they react to these losses and continue to move forward. Here are my recommendations on how to pick yourself up and actually improve yourself after suffering an unexpected loss.

|

RSS Feed

RSS Feed