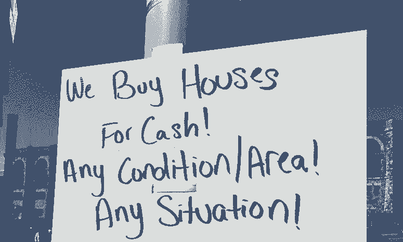

Last week we went over the most well known of all real estate investing techniques; Long Term Buy and Hold. This week we will look at a technique that has been a stepping stone for many successful investors but can also be used for a full-time real estate career. One of the reasons that wholesaling is a great place to start is because if done correctly, it requires very little up front capital and rewards those that are willing to "hustle" and put in some hard work. Definitions: Wholesaling - In real estate wholesaling, a wholesaler contracts a home with a seller, then finds an interested party (usually an investor) to buy it. The wholesaler contracts the home with a buyer at a higher price than with the seller, and keeps the difference as profit. Real estate wholesalers generally find and contract distressed properties but do not perform any rehab themselves. Wholetaling - Wholetaling is very similar to Wholesaling but the wholetaler may do some very light rehab just to get the property presentable and then sells it on the retail market to an interested buyer (usually someone that wants to live in the home). Simultaneous or Concurrent Close - A simultaneous or concurrent close is where the wholesaler or wholetaler closes on the property completing their purchase transaction with the seller and immediately closes with the investor or buyer to complete their sale transaction with the purchaser. This creates a situation where the wholesaler never really takes possession of the property and is able to profit instantly by keeping the difference between their purchase and sale price. How it works: A wholesaler gets a property under contract (generally distressed) and then immediately finds a buyer for a higher price, profiting from the difference in sale prices. Wholesalers spend the majority of their time scouring their market for under-priced properties that they can sell quickly at a profit. Some sources for acquiring these properties include:

How to invest: Wholesaling is not something that you really "invest" in per se. You just get out there and do it. Of course, there is some investment in education and the time of putting a team together. Good wholesalers are willing to work hard looking for deals and not afraid of some rejection as many or most of the offers you make will not be accepted. While wholesaling can be perceived as a dishonest practice of trying to screw someone out of their property, the good ones that I know focus more on solving a sellers problems in a way that is beneficial to all. Maybe that is offering a quick close, or some other type of terms that help everyone feel that they got a decent deal. Wholesalers also need to spend some time building a Buyers List. Once you have a property under a contract, you want to have a network of interested buyers so you can dispose of it quickly. Pros:

Where to get more information: Wholesale Real Estate for Beginners: Understanding the Process and How to Get Started What is Real Estate Wholesaling? Next week we will go over another very common technique known as Fix and Flip. This is the stuff that popular TV shows are made of but we'll look at the more realistic way it works and list some pros and cons. Please reach out to me with any questions or comments using the comments button or through the contact page on my web site. If you would like to talk more about any of these investment methods or discuss how we can partner together, please contact me.

0 Comments

Last week we went over the basics of investing in real estate through Private Lending. This week we will move into the most well known technique in real estate investing, Buy and Hold Investing. This technique has created generational wealth for millions of people worldwide and continues to grow fortunes for people ranging from small mom & pop landlords to multi-billion dollar real estate corporations. Definitions: Buy and Hold - Buy and hold investing is pretty self explanatory; an investor purchases property that they will own with the intent of renting it to a tenant for positive cash flow and/or holding on to the property long term in hopes of price appreciation creating a profit at sale. There are lots of "sub-techniques" to buy and hold investing but we are going to cover the basics of residential rental properties. Residential Real Estate - Residential real estate includes vacant land, houses, condominiums, and townhouses. Residential real estate can be either single family or multifamily dwellings. (For lending purposes complexes consisting of more than 4 units are typically considered commercial but we are going to lump these into residential for our discussion) Commercial Real Estate - Commercial real estate includes non-residential structures such as office buildings, warehouses, retail buildings, or storage units. How it works: Buy and hold investing is just it like it sounds, you buy a property and then hold on to it while earning passive cash flow and growing the equity (difference between the value of the property and what you owe on that property). There are five major ways that you will profit from a successful buy and hold real estate investment:

How to invest: Investing in buy and hold real estate requires you to decide what type of property best suits your style (i.e. single family home, small apartment complex, etc.) as well as what market you want to be in. It has become increasingly easier to invest in distant markets so don't fret if your home market doesn't make sense. You will need to assemble a team consisting primarily of a real estate agent, mortgage broker, property manager, and contractor (if you plan to do any rehab). Look for properties that can purchased at a price that allows you to make some cash flow after all of the expenses are paid. I also recommend looking in markets with a stable or growing economy and diverse job base. In another post, I will go through the basic underwriting you need to do to see if a property will cash flow. Pros:

Where to get more information: Bigger Pockets Guide to Buy and Hold Investing Buy and Hold Real Estate An Investors Guide Next week we will go over a technique known as Wholesaling. Wholesaling is a great way to get started in real estate investing when you have very little cash but have the time and hustle to find great deals for other investors. Please reach out to me with any questions or comments using the comments button or through the contact page on my web site. If you would like to talk more about any of these investment methods or discuss how we can partner together, please contact me.  In the last post we learned the basics about Investing in Real Estate Notes. This week we continue with another technique for investing that doesn't require the actual ownership of the physical property. This technique is known as Private Lending and is becoming a very popular to make a solid return that will beat most of the banking products and be secured by the physical asset. Definitions: Private Lending - Acting as the lender to other investors for the purpose of purchasing real estate

How it works: Private lending is simply the act of loaning money to an investor per agreed upon repayment terms. In most cases, you will have no active role in the real estate investment but will receive payments from the investor per the terms. You can (and should) have a security interest in the property that you are loaning on, meaning that if the investor doesn't pay you, you can foreclose on the property. How to invest: There are many ways to become a private lender. Here are some of the most common methods:

Pros:

Cons:

Where to get more information: millionacres.com nuwireinvestor.com Next week we will go over the most well known technique and still one of the greatest: Long term buy and hold real estate investing. Please reach out to me with any questions or comments using the comments button or through the contact page on my web site. If you would like to talk more about any of these investment methods or discuss how we can partner together, please contact me. |

RSS Feed

RSS Feed